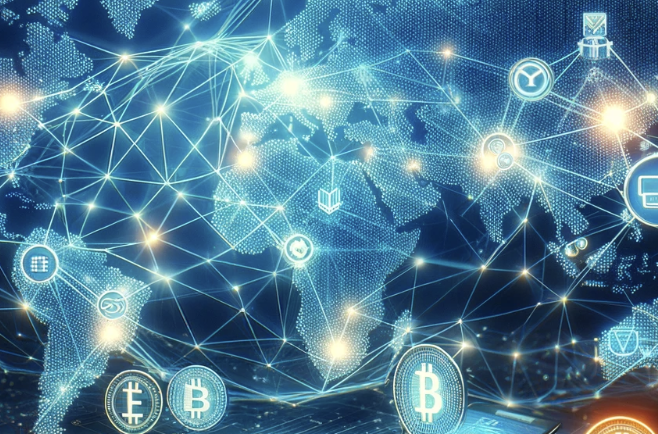

The financial sector, a bedrock of the global economy, is undergoing a seismic transformation, thanks to the advent and integration of blockchain technology. This groundbreaking innovation is not merely enhancing existing financial systems but is also redefining the very mechanisms of monetary transactions, asset management, and compliance across the globe. This article explores the multifaceted impact of blockchain on the financial industry, dissecting its potential to revolutionize everything from banking and payments to securities trading and beyond.

The Genesis of Blockchain in Finance

Blockchain technology, first conceptualized as the underlying framework for cryptocurrencies like Bitcoin, has evolved far beyond its initial purpose. Its attributes of decentralization, immutability, and transparency present unparalleled opportunities for the financial sector to address some of its most pressing challenges, including fraud prevention, transaction speed, and cross-border payments.

Revolutionizing Payments and Remittances

Perhaps the most immediate impact of blockchain technology has been in the realm of payments and remittances. By facilitating peer-to-peer transactions without the need for intermediaries, blockchain significantly reduces transaction costs and time. This is particularly transformative for international remittances, where traditional methods involve high fees and lengthy processing times. Blockchain technology offers a more efficient, cost-effective solution, directly benefiting consumers and economies at large.

Transforming Asset Management and Trading

Blockchain introduces a new paradigm for asset management and trading through the concept of tokenization—converting rights to an asset into a digital token on a blockchain. This innovation enables more efficient trading of assets, from stocks and bonds to real estate and art, by enhancing liquidity and enabling fractional ownership. Moreover, smart contracts automate and secure these transactions, reducing the need for manual processing and verification.

Enhancing Security and Compliance

In an industry plagued by security breaches and regulatory challenges, blockchain technology offers a robust solution. Its decentralized nature and cryptographic security measures significantly mitigate the risk of fraud and cyber-attacks. Furthermore, blockchain's transparent and immutable ledger simplifies compliance and auditing processes, providing regulators with a reliable and tamper-proof record of transactions.

Challenges and the Road Ahead

Despite its potential, the adoption of blockchain in finance is not without challenges. Regulatory uncertainty, scalability issues, and the need for industry-wide standards are significant hurdles that must be overcome. However, as technology evolves and stakeholders continue to engage with regulatory bodies, the path towards a blockchain-enabled financial future becomes increasingly clear.

Conclusion

Blockchain technology stands at the forefront of financial innovation, offering solutions to longstanding inefficiencies and opening up new avenues for growth and inclusivity. As we navigate this transformative era, the financial sector must embrace change, fostering collaboration between traditional institutions and fintech innovators to fully realize the potential of blockchain.