The financial sector is undergoing a seismic shift, influenced by the rapid advancements in technology, a growing emphasis on sustainability, and a strong push towards equity and inclusivity. This transformative phase is not just reshaping how financial transactions are conducted but also redefining the very ethos of investment and wealth management. This exploration delves into three critical areas at the forefront of this evolution: blockchain's role in enhancing transparency, the ascendancy of sustainable investment as a mainstream strategy, and the push towards democratizing finance for broader access and participation.

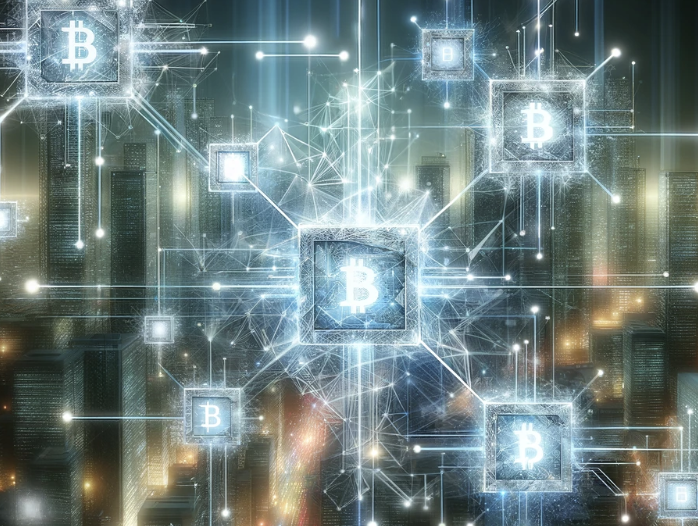

Blockchain: The Backbone of Transparent Finance

At the heart of financial innovation lies blockchain technology, a digital ledger that promises unparalleled transparency and security. Beyond its initial association with cryptocurrencies, blockchain is revolutionizing various facets of finance, including cross-border payments, supply chain finance, and identity verification. Its ability to offer secure, transparent, and tamper-proof transactions is paving the way for a new era of trust in financial services. Blockchain’s potential to democratize information and reduce fraud is not just a technological leap but also a step towards more ethical finance.

Sustainable Investment: The Green Revolution

The surge in sustainable investing reflects a profound shift in investor priorities, from mere profit generation to making a positive impact on the planet. Environmental, Social, and Governance (ESG) criteria are now integral to investment decisions, guiding capital towards companies that are not just economically viable but also environmentally responsible and socially equitable. This trend is supported by evidence that sustainable investments often deliver comparable or even superior returns to traditional investments, challenging the outdated notion that ethical considerations come at the expense of profitability. As more investors choose to support businesses committed to sustainability, we are witnessing the rise of a finance system that values long-term planetary health alongside economic growth.

Democratization of Finance: Empowering the Masses

The democratization of finance represents a significant cultural shift towards inclusivity and equity in the financial landscape. Technology-driven platforms have lowered barriers to investment, making financial markets accessible to a broader audience than ever before. From crowdfunding and peer-to-peer lending to micro-investment apps, new tools are empowering individuals with limited resources to participate in financial activities traditionally reserved for the wealthy. This inclusivity not only fosters a sense of empowerment among underserved populations but also stimulates economic growth by mobilizing a larger pool of capital.

These pivotal changes signal the dawn of a new era in finance, characterized by transparency, sustainability, and inclusivity. As we navigate this evolving landscape, it is imperative for stakeholders across the financial ecosystem to embrace these trends, recognizing that the future of finance lies in building a system that is equitable, resilient, and aligned with the broader objectives of society.